Cognito Broadcast

Introducing our reinvented watchlist platform, Cognito Screening

After working with hundreds of enterprise companies for what we thought was standard KYC and AML product research, we quickly discovered that even the largest organizations had seriously flawed compliance screening programs. The most common findings were inadequate screening controls, overall misinterpretations of regulations, and an inappropriate risk appetite. Beyond misunderstandings, many organizations weren’t proactively protecting themselves from fraud. Their use of manual systems allowed human error which was only exacerbated by adding headcount rather than overhauling or replacing antiquated systems and processes.

Why, within such a critical business function, does a lack of automation persist? While “flexibility and customization” may be trending features, it’s worth questioning whether they’ve become a disservice if not a liability. How can we as a vendor provide expertise along with guardrails? In building our latest product, we placed more emphasis than ever on being an expert for our customer. Building a best in class product that guides you through confusing regulations to protect your business.

With its industry-leading screening capabilities, Cognito’s watchlist solution is the platform that today’s compliance-conscious companies need. And now, we’re pleased to be rolling out the latest iteration.

Highlights include:

- Manually enriched watchlist data to make it easier to investigate hits and programmatically review them.

- Automatic daily rescans for all of your customers.

- Support for transliteration across 18 different languages.

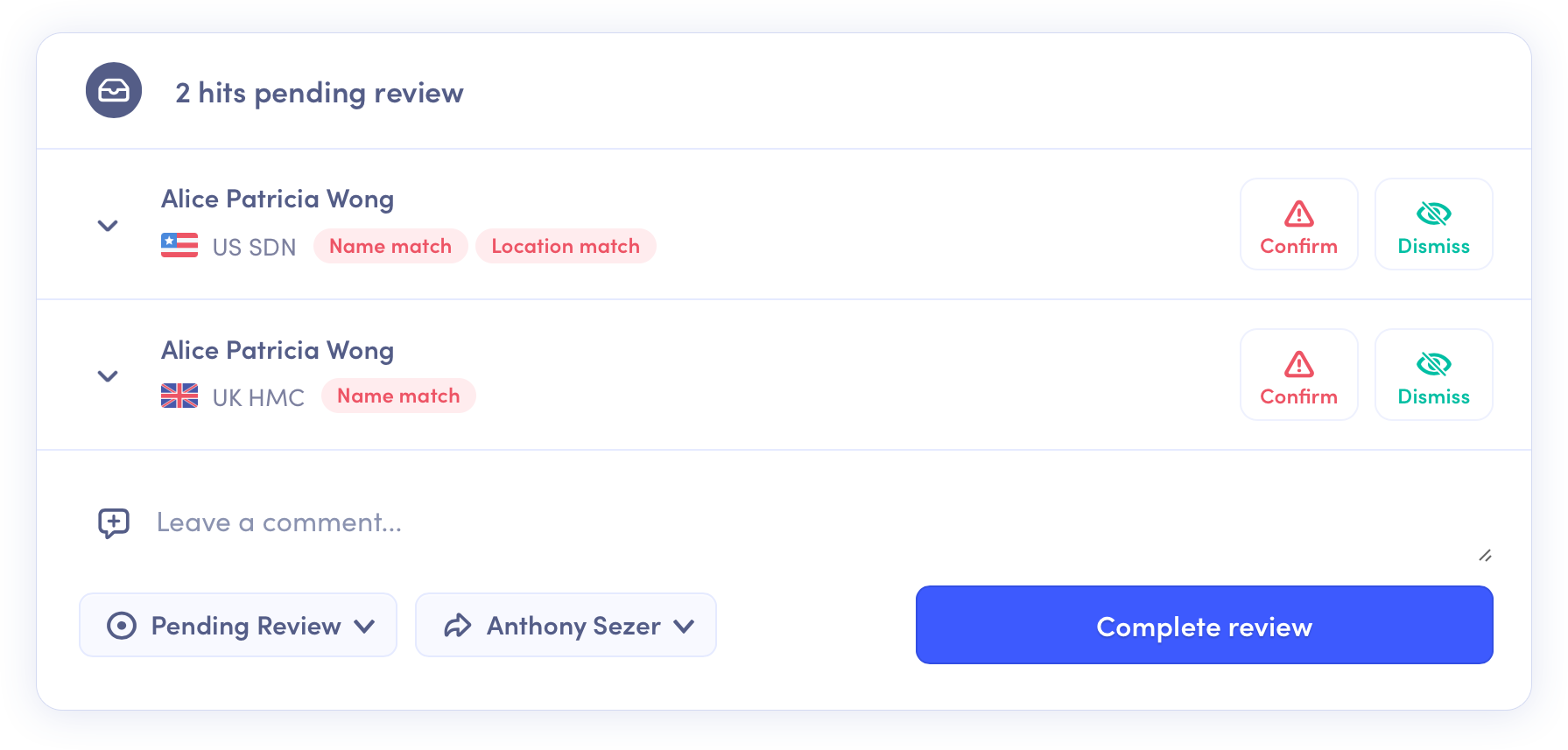

- A full compliance CRM for handling hits and viewing results (that can also be entirely controlled via API).

- Unlimited free re-searches for a customer if their information updates (name, location, etc).

- Persistent audit trails for all actions that take place on the dashboard and API.

- A completely updated search algorithm to help improve search relevance.

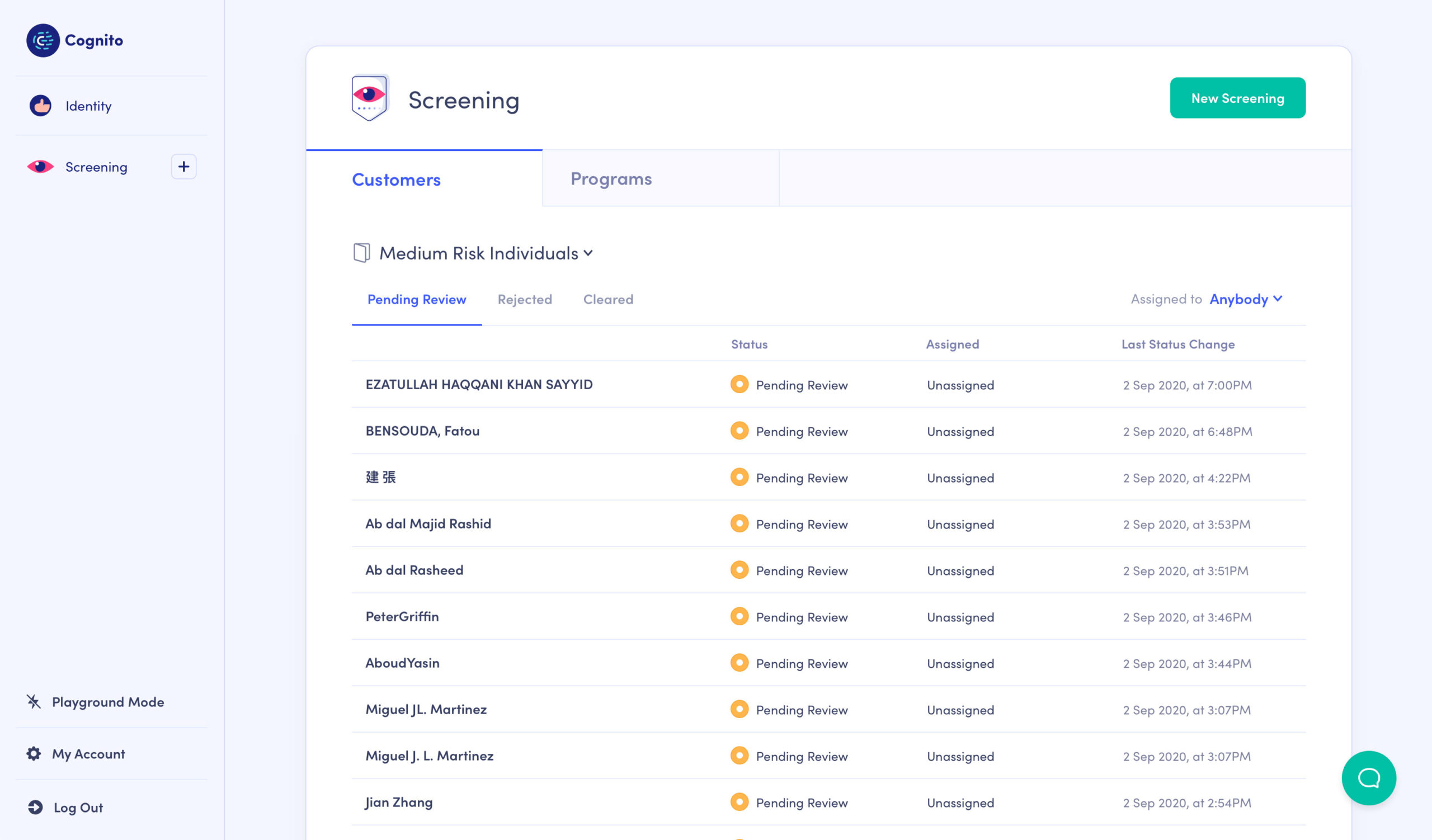

Enjoy automatic scanning at scale

Unlike other screening solutions on the market that provide only periodic or manual monitoring and change tracking, Cognito is automatic: our solution rescans all users on an ongoing basis. No breaks, no gaps — with Cognito you can:

- See continuous up-to-date status for all your customers.

- Maintain comprehensive audit trails.

- Take notes on activity.

- Automatically assign agents to manage accounts.

- Monitor compliance in our appealing dashboard or API.

Not only do these regular risk assessments reduce your manual workload and let you focus your efforts on high-priority accounts, but they surpass industry best practices.

Cognito is also geared for your growth. Our compliance CRM has the capability to scale with your organization, so you’ll no longer need to switch solutions as your company expands. Even if you have more than 100 million customers, seamless scanning and rescanning is automatic, letting you catch even the smallest changes in the status and profiles of each user.

Identify PEPs without burdening in-house teams

Anti-Money Laundering (AML) regulations not only let you watch your customers’ backs — they help you watch your own too. That’s because these rules prevent financial services companies from aiding and abetting criminal activity. For organizations whose customers could include politically exposed persons (PEPs), AML compliance is critical.

For Cognito, it’s all about preventing financial crime while providing unparalleled accuracy. We use industry-leading search algorithms to help you surface potential matches for all your customers from an extensive list of regulated databases — and immediately raise any red flags. These algorithms come ready to deploy with our watchlist solutions, which means you no longer have to divert your developer resources into building and operating these functionalities on your own — and can take advantage of a seamless user experience right away.

Reap the benefits of intelligent global language handling

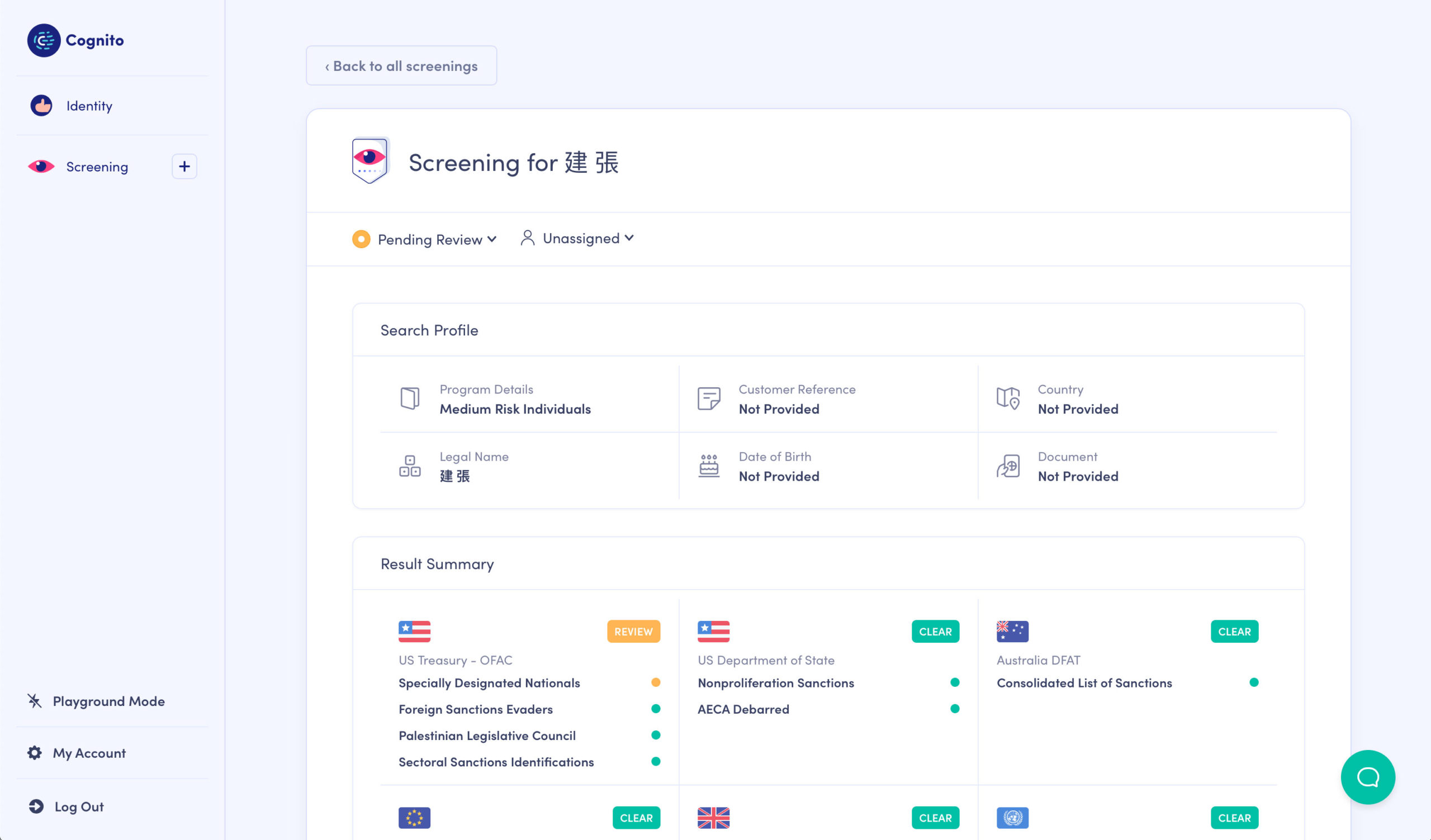

All you need to begin an effective Cognito verification search is a name. Cognito:

- Scans for names with phonetic similarity, nicknames, initials, titles and honorifics, and missing or truncated components.

- Compares results against official, reliable government data.

- Gathers crucial supplementary information, including the customer’s location, passport, date of birth, and other relevant insights.

- Uses intelligent global language handling to conduct automatic cross-comparisons across 18 of the world’s most widely-spoken languages.

By highlighting customers with risk factors, you can assign accounts to a more senior agent, increase the sensitivity of your match settings, and triage your reviews and investigations.

An industry-leading compliance CRM that keeps getting better

There are a variety of reasons why there might be a hit during the customer screening process, and different companies have different priorities. Cognito’s compliance CRM is designed to learn what yours are, so it can constantly refine why, how, and when it flags hits for immediate review.

At Cognito, we understand that sanction and PEP screening is the first critical step in preventing financial crime. That’s why we’ve designed a robust, proactive system that combines automation, search algorithms, and self-learning analytics to deliver meaningful results. Finally, you have a compliance CRM that focuses on the things financial organizations truly care about.

Find out more about how Cognito's watchlist solution can work for you.